Pvm Accounting - Questions

Pvm Accounting - Questions

Blog Article

The 10-Second Trick For Pvm Accounting

Table of ContentsNot known Factual Statements About Pvm Accounting The Best Strategy To Use For Pvm AccountingThings about Pvm AccountingGetting The Pvm Accounting To WorkRumored Buzz on Pvm AccountingThe Best Strategy To Use For Pvm AccountingThe smart Trick of Pvm Accounting That Nobody is Talking About

In terms of a company's total technique, the CFO is in charge of guiding the firm to fulfill financial goals. A few of these strategies might involve the firm being acquired or acquisitions moving forward. $133,448 each year or $64.16 per hour. $20m+ in yearly revenue Specialists have developing needs for office supervisors, controllers, accountants and CFOs.

As an organization grows, bookkeepers can free up more team for other service responsibilities. As a building and construction business grows, it will require the aid of a permanent monetary staff that's managed by a controller or a CFO to handle the business's financial resources.

Everything about Pvm Accounting

While big services could have full-time financial support groups, small-to-mid-sized companies can hire part-time bookkeepers, accounting professionals, or financial consultants as required. Was this write-up useful? 2 out of 2 individuals discovered this helpful You voted. Change your response. Yes No.

Efficient bookkeeping methods can make a substantial distinction in the success and development of construction business. By implementing these methods, construction organizations can enhance their monetary stability, enhance procedures, and make informed decisions.

Detailed estimates and budgets are the foundation of construction job monitoring. They help steer the project towards prompt and successful conclusion while securing the interests of all stakeholders involved. The crucial inputs for project price estimate and spending plan are labor, materials, equipment, and overhead expenditures. This is normally one of the largest expenditures in building projects.

Pvm Accounting Fundamentals Explained

An exact estimation of products required for a job will certainly assist make certain the necessary products are bought in a timely fashion and in the ideal amount. A misstep here can result in wastage or hold-ups as a result of product scarcity. For a lot of building and construction projects, equipment is needed, whether it is bought or leased.

Appropriate equipment estimation will certainly help ensure the ideal devices is available at the correct time, conserving money and time. Do not forget to account for overhead expenses when approximating job prices. Direct overhead expenditures specify to a project and might include short-term leasings, utilities, fencing, and water materials. Indirect overhead expenditures are daily costs of running your service, such as lease, management wages, energies, taxes, depreciation, and advertising and marketing.

Another element that plays into whether a project succeeds is an accurate price quote of when the job will certainly be finished and the associated timeline. This quote helps make certain that a job can be ended up within the allocated time and resources. Without it, a job may lack funds before conclusion, triggering prospective work interruptions or abandonment.

The Best Strategy To Use For Pvm Accounting

Precise job setting you back can help you do the following: Recognize the profitability (or lack thereof) of each job. As work setting you back breaks down each input into a job, you can track productivity separately.

By identifying these things while the project is being pop over to these guys completed, you prevent surprises at the end of the job and can resolve (and hopefully prevent) them in future projects. One more tool to aid track tasks is a work-in-progress (WIP) schedule. A WIP routine can be completed monthly, quarterly, semi-annually, or every year, and consists of project information such as contract value, costs incurred to day, total approximated costs, and total task payments.

Unknown Facts About Pvm Accounting

It additionally offers a clear audit path, which is vital for financial audits. construction bookkeeping and compliance checks. Budgeting and Projecting Devices Advanced software uses budgeting and forecasting abilities, permitting building firms to intend future jobs much more accurately and handle their financial resources proactively. Paper Management Building projects entail a great deal of documents.

Enhanced Vendor and Subcontractor Monitoring The software can track and take care of repayments to suppliers and subcontractors, guaranteeing timely payments and preserving good connections. Tax Obligation Preparation and Filing Bookkeeping software application can assist in tax obligation preparation and filing, ensuring that all pertinent economic activities are precisely reported and tax obligations are filed promptly.

The Of Pvm Accounting

Our client is an expanding advancement and building firm with headquarters in Denver, Colorado. With multiple energetic construction tasks in Colorado, we are searching for an Accountancy Assistant to join our team. We are seeking a permanent Bookkeeping Aide who will be responsible for providing practical support to the Controller.

Obtain and review day-to-day invoices, subcontracts, change orders, acquisition orders, examine requests, and/or various other relevant documentation for completeness and compliance with economic policies, procedures, spending plan, and legal needs. Update month-to-month analysis and prepares spending plan fad records for building and construction projects.

3 Simple Techniques For Pvm Accounting

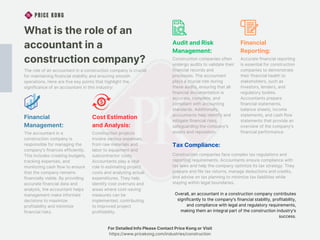

In this overview, we'll look into different facets of construction bookkeeping, its significance, the standard devices utilized in this area, and its duty in building and construction projects - https://www.provenexpert.com/leonel-centeno/?mode=preview. From economic control and expense estimating to capital administration, explore how accountancy can benefit building projects of all ranges. Building and construction accounting refers to the specific system and procedures used to track financial details and make critical choices for construction businesses

Report this page